About us

Photonics BW e.V.

Photonics BW e.V. is the non-profit innovation network for the promotion of optical technologies and quantum technologies in research, development and application, training and further education as well as the promotion of young talent and public relations work in Baden-Württemberg.

We currently unite around 90 members from industry, SMEs, start-ups, research, banks and consulting institutions from Baden-Württemberg and beyond.

Our services and activities at a glance

Get to know our services

- Networking

- Consulting

- Technology transfer

- Innovation promotion

- Working groups

- Marketing and public relations

- Promotion of young talent

- Training and further education

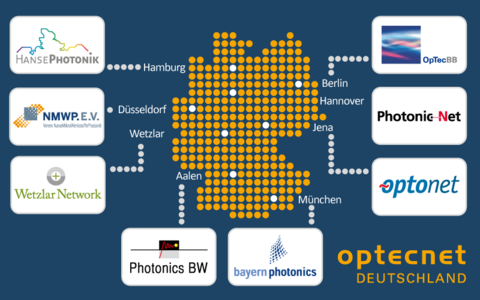

OptecNet Deutschland e.V.

Photonics BW is a member of OptecNet Deutschland e.V., the nationwide umbrella organization of the nine regional innovation networks for optical and quantum technologies.

OptecNet Deutschland brings together around 600 members from industry, science, education, consulting and finance to promote photonics and quantum technologies.

Awards

As part of a European evaluation process, Photonics BW was awarded the Bronze Label of the European Cluster Excellence Initiative in 2011. In 2012, 2015 and 2017, 2021, the network received the Cluster Excellence Baden-Württemberg quality label after a strict and comprehensive review of 34 quality indicators and in 2013, 2016 and 2018, 2021 the EU quality label Cluster Management Excellence in Gold.

Note on the membership fees of Photonics BW e.V. and the tax savings due to the non-profit status

The non-profit registered association Photonics BW e.V. exclusively and directly promotes the charitable purpose of “promoting science and research”. Photonics BW e.V. fulfills the charitable purposes in accordance with § 5 para. 1 no. 9 KStG and is exempt from taxation in accordance with §§ 51 ff. AO are exempt from tax.

Photonics BW e.V. is therefore authorized to issue donation receipts for membership fees and donations in accordance with the officially prescribed form (§ 50 para. 1 EStDV).

These donation receipts can be claimed for tax purposes and can result in savings on corporation tax and trade tax.